Environmental Due Diligence Minimises & Limits Transaction Risks

Since 1985, the number of company transactions has risen twentyfold. At the same time, the effort of negotiations before a transaction have also risen considerably. The process of investigating all facts, conditions, rules, laws, regulations, financial considerations, or any other such matters that would affect one's decision to purchase property is called due diligence assessment.

Although an environmental due diligence assessment (EDDA) is not legally required, anyone who acquires a company or a property from which environmental risks arise can also be made liable for this. Strict compliance guidelines and the more deliberate handling of money and assets do their utmost to ensure that the EDDA is becoming more and more important.

It is important to consider not only the actual situation but also to check whether the transaction corresponds to future laws and regulations.

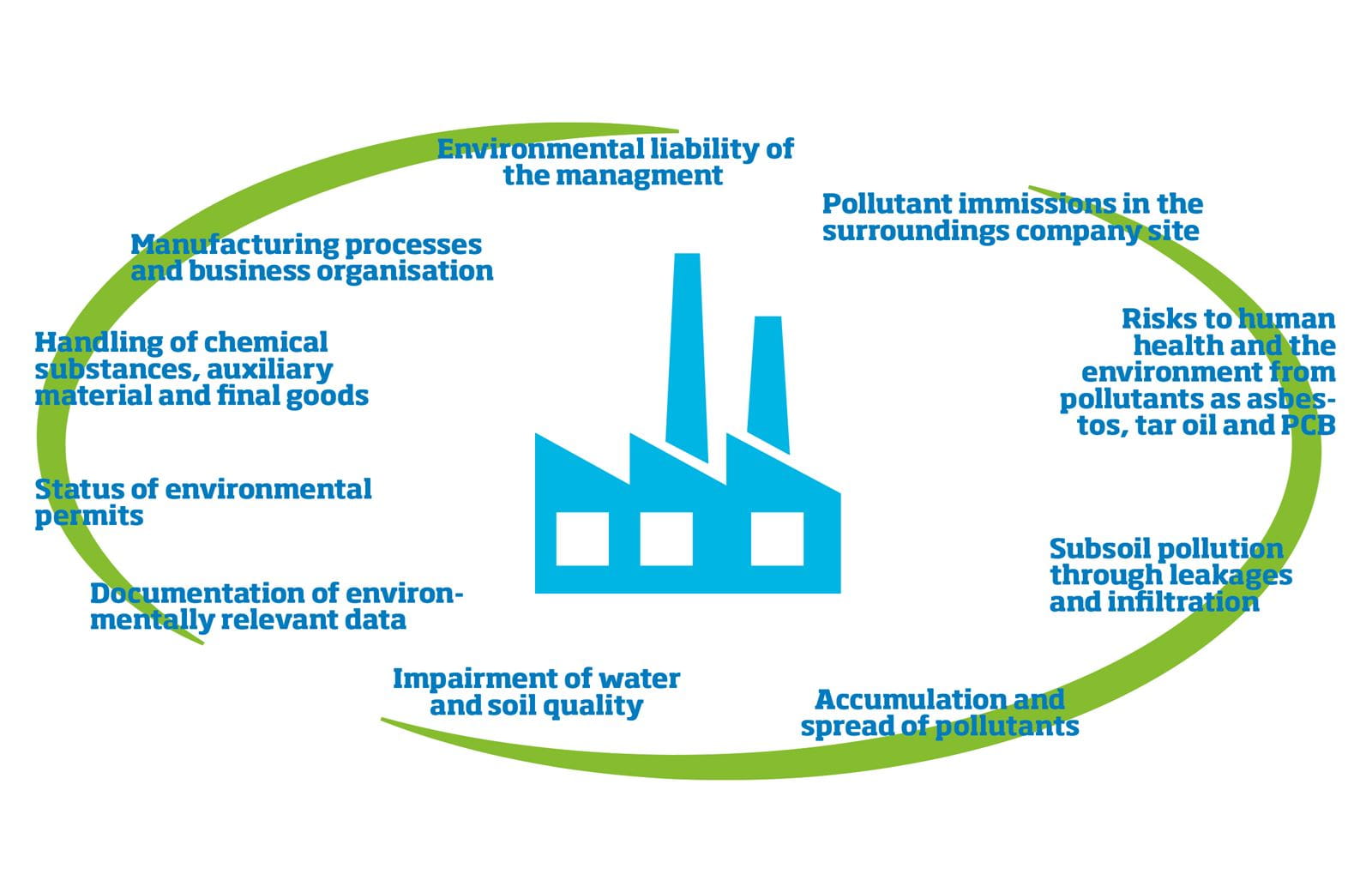

As an increasing number of potential buyers evaluate the legal, fiscal and financial situation, the environmental condition of the target is often neglected. This however becomes even more crucial, as the value of the target is significantly dependent on its environmental risks and the liability risks it is exposed to. It is therefore important to take a close look at possible environmental risks and the resulting liability within the scope of the due diligence process. Legislative changes foreseeable at the time of the transaction are included in the evaluation. Possible environmental risks or provisions for the elimination of environmental damage can thus be directly integrated into the sales and purchase agreement and reflected in the purchase price.

An EDDA is also relevant from the seller's perspective. For this reason, in addition to the buyer's due diligence (Buyer DD), a seller's due diligence (Seller DD) is also highly recommendable. This serves to document the environmental risks or damage at the time of the sale from the seller´s point of view. The Seller DD thus represents the ideal starting point for the sales negotiations of the Buyer DD.

International Standards

CDM Smith audits use procedures that apply across the globe while taking into account local requirements specific to a country or region. Our assessment criteria include the following standards in their current version:

- Environmental Liability Directive (2004/35/EC)

- ASTM 1527: Standard Practice for Environmental Site Assessment Process: Phase I Environmental Site Assessment Process

- ASTM 1528: Standard Practice for Limited Environmental Due Diligence: Transaction Screen Process

- ASTM 1903: Standard Practice for Environmental Site Assessments: Phase II Environmental Site Assessment Process

- ASTM E2107: Standard Practice for Environmental Regulatory Compliance Audits

- ASTM E2365: Standard Guide for Environmental Compliance Performance Assessment

You can rely on CDM Smith as a competent partner through all EDD phases.